EQUITY INVESTMENT IN DORADO 64

Did you see the advert in the West Australian on the 25/10/25?

We are looking for investors in the above Dorado Property equity investment in Dorado 64. There is a good possibility that you have not received your full entitlement of your investment.

It would be beneficial for you to read points 1 - 7 below which will draw your attention to some of our findings. In particular, we have provided references to the Corporations Action 2001 which believe have been overlooked.

Please share your thoughts or request information by clicking on the box at the end of each section.

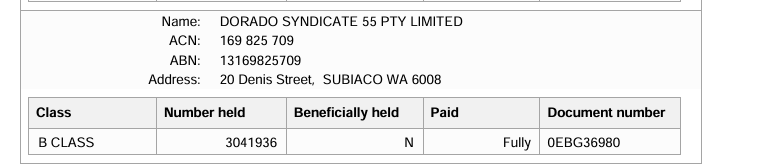

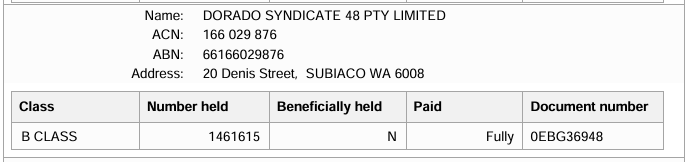

Were you an investor in DORADO 48 and DORADO 55?

Are you aware that Dorado Financial Service AFS Licence was used by Registered Custodians Pty Ltd to issue B Class shares. Please see ASIC extracts to the right and refer to point 8 below.

Were you paid out on these B Class shares?

Please share your thoughts or request information by clicking on the box at the end of section 8.

1. Dorado Financial Services Pty Ltd ACN 118 060 825 AFS Licence 306994

An Australian Financial Services Licence (AFSL) is required under the Corporations Act (with ASIC as the regulator) for any financial services/investment schemes involving the general public and in this case Sophisticated Investors.

Registrar Custodians Pty Ltd (see point 2 below) as Dorado Financial Services Pty Ltd’s representative can only act with an AFSL, and in this case utilises the AFSL of Dorado Financial Services Pty Ltd.

AFS licensees have obligations relating to:

Efficient, Honest, and Fair Service Provision

Licensees must deliver financial services efficiently, honestly, and fairly, at all times. This is enforced both through ASIC monitoring and by law under s912A of the Corporations Act 2001.

Compliance Management Systems

Comprehensive compliance systems are required. This includes documented policies and procedures in order to ensure ongoing adherence with financial services law and to manage conflicts of interest. This covers staff training, compliance audits, recordkeeping, and breach reporting.

Competency and Training

Responsible managers and, where relevant, advisers and representatives who must demonstrate sufficient experience, competence, and ongoing professional development. ASIC will assess qualifications and may remove or suspend authorisation for inadequate standards.

Adequate Financial and Human Resources

Licensees must maintain enough financial, technological, and human resources to operate soundly. This includes satisfying financial requirements (net tangible asset and cash flow tests) and ensuring sufficient staffing and IT support.

Dispute Resolution and Compensation Arrangements

Retail-facing licensees must belong to an external dispute resolution scheme and have arrangements in place to compensate clients for losses caused by licensee breaches. This protects clients and meets mandatory consumer law requirements.

CLICK THIS BUTTON TO REQUEST OR SEND ADDITIONAL INFORMATION

3. A.F.C.A.

Asset and Shareholder Records

Dorado Financial Services Pty Ltd or Dorado Property Pty Ltd should maintain a separate list of assets held by Registrar Custodians Pty Ltd for each investment, as a matter of responsible record keeping and transparency.

Records, including shareholder lists, must be retained for up to 7 years and be available for provision upon request. A list of shareholders by name should be accessible.

Registrar Custodians Pty Ltd, as the custodian, is obligated to maintain a list of fellow shareholders and redeemable shareholders

Shareholder Communication and Rights

The company failed to provide regular statements or audited results.

No communications were provided to shareholders, depriving beneficial owners of shares and notes the chance to exercise their rights, as required under the Corporations Act 2001.

Statutory Register Access

Under section 173 of the Corporations Act 2001, any member—including ordinary or redeemable shareholders—has a statutory right to inspect the register of members for free.

Upon request, the company must provide a copy of the register within 7 days.

Register Content Requirements

The shareholder register must include names, addresses, shareholdings, classes of shares (ordinary and redeemable), amounts paid, and other essential data.

Any member may inspect the register without charge and request a copy.

CLICK THIS BUTTON TO REQUEST OR SEND ADDITIONAL INFORMATION

4. Information Memorandum

Equity definition

The information Memorandum refers to the investment as an “Equity” investment.

Equity definitions refers to treating every investor fairly according to their needs and ensuring no group receives special treatment, as defined by the Cambridge Dictionary.

The basic formula for calculating equity in the project is: Gross Sales minus Gross Liabilities equals Equity.

Dorado 64, however, has managed this as a loan rather than an equity investment.

Notes, Shares, and Voting Rights

Notes and shares were issued to investors, and voting rights are attached to both.

ASIC approval is required if voting rights are to be withdrawn from either notes or shares.

If Dorado 64 originally issued share and note certificates and these are re-issued by another company during the investment term, this action requires notification to share/note-holders and ASIC (typically by, in this case, Registrar Custodians Pty Ltd).

Conversion of shares to Redeemable Shares or Redeemable Preference Shares can only proceed if 75% of share/note-holders vote in favour.

No share/note-holder meetings or voting took place.

Equity Disclosure and Terminology

Equity is spelled out in Dorado 64’s information letters, indicating parity with other investors such as Pindan Capital and WINIM in the project. Parri -Passu is spelt out with the other Equity Investor.

The terms used across documentation including “Purchasing of land/property,” “Investment/Investors,” “Development and sale,” “Profit Share,” “Gross earnings share,” “Audited figures,” and “Return to investors”—refer to participation in the profits, thus defining equity.

Ignored by the management company, Dorado Property.

Investment Opportunity and Payment Discrepancies

The executive summary outlined an equity investment opportunity in a property syndicate with capital repayment and a gross return of 15% per annum.

The final gross return of 15% per annum was not received, requiring investigation. Based on calculations, this could result in a shortfall of approximately $1,500,000 to Dorado 64 share/note-holders.

A qualified Chartered Accountant identified a minimum underpayment of approximately $407,000, representing over a 60% shortfall.

Class Shares and Corporate Governance Concerns

Three (3) B Class shares were allegedly issued to related parties of Dorado Property Pty Ltd directors but were not disclosed in the Information Memorandum, as required under the Corporations Act 2001.

The attached rights to these shares were not previously disclosed, and the shares were redeemed early in 2017 before the final payout in 2019. This pattern may be ongoing and systematic.

This raises transparency and governance concerns and an evident conflict of interest.

Investment Returns and IRR

The IRR in the Information Memorandum decreased from a potential 22% to a final 7.95%, a reduction of nearly 64%.

Registered Offices and Compliance Issues

Two ASIC-registered offices were listed: One at the accountants and one at the Dorado head office, which may contradict Corporations Act 2001 requirements.

Further transgression in managing company records.

Other Compliance Issues

Addresses of developed apartments and commercial properties funded by Dorado 64 were not mentioned in the Information Memorandum. Examples include 1/2 East Lane and 2 Edan Lane, North Sydney.

Audited results have not been supplied, which raises further transparency concerns.

CLICK THIS BUTTON TO REQUEST OR SEND ADDITIONAL INFORMATION

5. ASIC Governance and Regulation

Deregistration of Dorado 64

The rapid deregistration of Dorado 64 after the project ended raises concern, especially given the complexity of reinstating a deregistered company. This complicates later investigations seeking information about company actions.

Deregistration can occur voluntarily, with shareholder agreement, after business ceases and liabilities are cleared; or it can be initiated by ASIC if obligations go unmet or the company is wound up.

Ordinary Shareholders were not advised of or voted on the deregistration (75% approval required).

Share Conversion Processes

Converting shares to redeemable or redeemable preference shares and notes should be communicated to the initial equity holders, with share/note-holder approval (usually 75% or more) required before conversion.

Registrar Custodians Pty Ltd did not notify shareholders of the conversion of ordinary shares to redeemable shares. Refer 254G and 254G(3) of Corporations Act 2001.

This omission breaches ASIC notification requirements under the Corporations Act 2001, potentially invalidating the conversion process.

Project Management and Potential Conflict

Dorado Property Pty Ltd, Dorado 64, Registrar Custodians Pty Ltd share several directors, creating a possible conflict of interest.

Dorado Financial Services Pty Ltd under their AFSL have obligations for these companies and is required to comply to the Corporations Act 2001 and ASIC requirements.

CLICK THIS BUTTON TO REQUEST OR SEND ADDITIONAL INFORMATION

6. A.C.C.C.

Misleading and Deceptive Conduct

There is significant concern that the Information Memorandum distributed to investors may have been misleading and deceptive, contravening section 18 of the Australian Consumer Law (2010).

Promotional brochures from Dorado Property Pty Ltd claimed a "perfect track record of capital and projected interest," which may be subject to scrutiny for veracity and substantiation.

Investment Structure and Unauthorised Changes

The investment was originally marketed as an equity investment, but was later converted, without notice, to a loan arrangement for the project, affecting more than 24 Sophisticated Investors.

The sudden change in investment nature, implemented without proper disclosure, raises issues under both the Australian Consumer Law and New South Wales Fair Trading legislation.

Disclosure of Risks and Compliance

The "Investment Strategy and Risks" section of the Information Memorandum outlined the investment strategy, but failed to adequately specify the risks associated with the project, potentially misleading investors about the true nature of the investment risk profile.

Regulatory Obligations and Filings

Registrar Custodians Pty Ltd have not submitted ASIC Forms 246-B or 246-G, nor Form 211, as required for changes to share classes and corporate records.

Failure to lodge these forms may constitute a breach of Corporations Act 2001 and related ASIC compliance obligations.

Conflicts of Interest and Associated Entities

There is evidence of conflicts of interest: Dorado 64’s directors also acted as managers, and shares (B class) were issued to associated entities—(3)three Pty Ltd companies , each were issued 1 B share each —all 3 companies are linked to the Dorado Directors , but not disclosed to other shareholders in the Information Memorandum.(Nor were the 3 Issued to Dorado Property Pty Ltd .

Undisclosed Ownership Interests

In at least one instance, directors claimed to "own" the company that the Sophisticated Investors held equity in; however, no details regarding these ownership interests were provided in the Information Memorandum.

CLICK THIS BUTTON TO REQUEST OR SEND ADDITIONAL INFORMATION

7. Overseas Investors

Foreign investors in Australian syndicates must comply with both Australian regulations (including FIRB approval if thresholds are crossed) and their home-country’s financial laws, but their identities are usually only known to syndicate managers, the company, and regulatory bodies. Public listings or registration documents may sometimes reveal the names and jurisdictions of significant foreign shareholders, but this information is not typically released unless required by law or requested through formal channels

CLICK THIS BUTTON TO REQUEST OR SEND ADDITIONAL INFORMATION

8. B Class Shares Issued for Dorado 48 & Dorado 55

Dorado 48 ACN166029876

Our company had 49,505 of the total 1,461,615 shares. All shares were converted to B Class shares.

We note that these shares were converted into B Class shares held in trust on behalf of us by Registrar Custodians ACN 151 072 007

Refer ASIC extract 1274A page 7.

Dorado 55 ACN 169825709

Our company had 99,010 of the total 3,041,935 shares. All shares were converted to B Class shares.

We note that these shares were converted into B Class shares held in trust by Registrar Custodians ACN 151 072 007

Refer to ASIC extract 1274A page 8.

All shareholders should be afforded the exact same terms and conditions that were afforded to Dorado Property Pty Ltd who were issued B Class Shares without informing other shareholders in the Information Memorandums. This indicates misleading and deceptive behaviour as we were paid out as redeemable shareholders (not ordinary). See sections 1041H and 1041E of the Corporations Act 2001.

CLICK THIS BUTTON TO REQUEST OR SEND ADDITIONAL INFORMATION

2. Registrar Custodians Pty Ltd ACN 151 072 007

Registrar Custodians Pty Ltd, as custodian of Dorado 64 and as Dorado Financial Services Pty Ltd’s representative, is responsible for safekeeping assets, transaction settlement, regulatory compliance, record keeping and investment administration. Refer to the link Regulatory Guide RG 133 Funds management and custodial services

The Information Memorandum and share certificate referenced the issuance of ORDINARY shares. However, on the ASIC Relational Company Extract of Registrar Custodians Pty Ltd the shares are listed as REDEEMABLE shares. Have Registrar Custodians Pty submitted 246-B, 246-G, 254B, 254G, 254G(3), 254A, 254X and Form 211 regarding the conversion of shares? Failing to do so may result in the conversion being invalid.

In addition, there is no record of them performing to ASIC strict criteria in relation to organisational structure and separation of custodial staff from investment staff. Have they ensured staff have capabilities and the relevant training skills in relation to the holding of assets in trust for clients (the financial reserves required), separation of assets from their own assets, providing quarterly cash flow projections, annual audits etc?

Information recently provided by Dorado Property Pty Ltd through their lawyers is incomplete - it does not reflect the position of shares.